Financial education is a critical life skill, yet it’s often neglected in our traditional curriculum. As students prepare to navigate the complex world of money, teaching them financial literacy becomes essential. One engaging way to achieve this is through interactive financial games.

In this blog, we are going to take a look at seven interactive financial games that can help students grasp key financial concepts and develop responsible money management skills.

Let’s start by understanding why financial education for kids matters. With the rise of changing lifestyle, using credit cards, and a competitive job market, young adults face numerous financial challenges. Financial education equips them with the knowledge to make informed decisions about budgeting, investing, and saving for the future. So, through proper financial education you can achieve financial security.

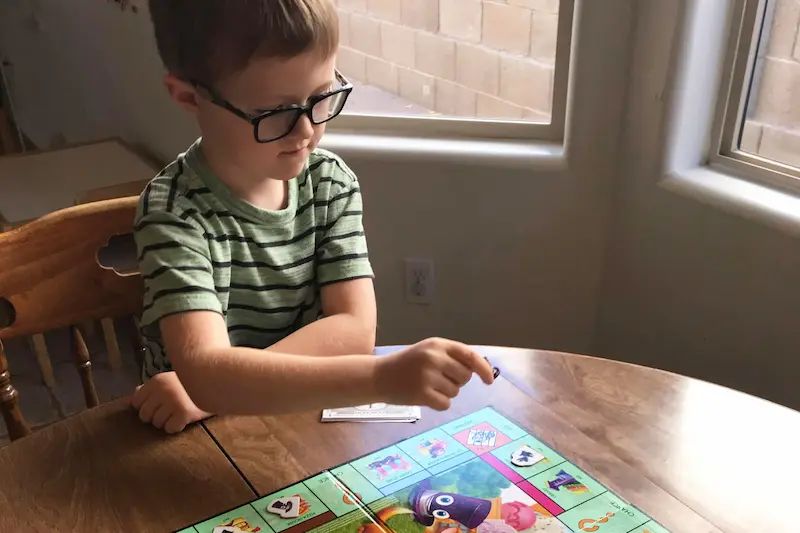

Games are an effective way to teach financial literacy for students because they make learning engaging and enjoyable. They simulate real-life financial scenarios, allowing students to practice making decisions without real-world consequences. Now, let’s explore these seven interactive financial games.

7 best financial games for kids:

Created by Robert Kiyosaki, author of “Rich Dad Poor Dad,” Cashflow 101 is an educational game that equips players with vital financial knowledge. It serves as a gateway to the intricacies of investing, asset management, and comprehending financial statements.This game provides a dynamic introduction to real-world financial concepts.

Monopoly, the timeless board game, is a captivating way for students to understand the realm of money management, negotiation, and property investment. As players navigate the board, they learn valuable lessons about buying, selling, and making shrewd financial decisions.

Most people don’t even know what are stocks. It’s one of the most important financial assets. Numerous online platforms offer stock market simulation games. These virtual environments enable students to invest fictional money in actual stock markets, fostering a deep understanding of stocks, trading strategies, and the dynamics of financial markets—all without risking real capital.

The Game of Life, a classic board game, mirrors an individual’s journey through life. It encompasses pivotal elements such as career choices, investments, and financial decisions which is the part of self improvement. By engaging with this game, students gain insights into the financial aspects of life planning.

Developed by Visa, Financial Football ingeniously merges football with financial literacy. Players advance by answering financial questions, imparting essential money management skills while they navigate the field.This interactive approach makes learning about finances engaging and enjoyable.

Payday is a board game that simulates the monthly budgeting challenges many individuals face. Players are tasked with paying bills, managing expenses, and making investment choices. Through this game, students grasp the importance of budgeting and sound financial planning.

Money Talks is one of the best financial literacy games for high school students, it focuses on real-life financial scenarios they may encounter as they transition to independence.

This interactive game covers topics like budgeting, student loans, credit cards, and financial planning for the future. Students navigate through different financial challenges and make informed choices that impact their financial well-being.

Money Talks equips you with the practical skills, knowledge, and financial literacy to keep you out of any financial crisis.

Strategies for Effective Game-Based Learning: Learn how to make the most of financial games to ensure maximum educational impact.

How Teachers and Parents Can Support Financial Education: Discover ways teachers and parents can collaborate to enhance students’ financial literacy.

Challenges and Solutions in Implementing Financial Games: Address common challenges and find solutions when integrating financial games into the curriculum.

Incorporating interactive financial games into a student’s education can make the journey to financial literacy enjoyable and effective. By immersing themselves in these engaging activities, students can develop essential money management skills that will serve them well throughout their lives. So, why wait? Start playing and learning today!To get your hands on more such educational and free resources on coding, robotics, game development, etc., do check out the Brightchamps Blog Page now!

To get your hands on more educational and free resources on coding for kids, robotics for kids, financial education for kids, etc., do check out the BrightCHAMPS Page now!

A1. To find the best financial games for your students, start by researching reputable educational websites, app stores, and educational game reviews. Look for games that align with your students’ age and learning level, and consider those created by established financial education organizations or endorsed by educators. Additionally, seek recommendations from fellow teachers or educational forums to get insights into what has worked well for others.

Q2. Are there free financial games available?A2. Yes, there are free financial games available. Many educational websites and app stores offer free financial games designed for various age groups. These games can be a cost-effective way to introduce financial concepts to your students. However, be sure to review the games to ensure they are high-quality and suitable for your educational goals.

Q3. What age groups are these games suitable for?A3. Financial games come in various levels of complexity and are designed for different age groups. You can find games suitable for preschoolers to high school students and even college-level learners. It’s essential to choose games that match the age and cognitive development of your students to ensure that they are engaging and educational.

Q4. How do financial games improve students’ financial skills?A4. Financial games enhance students’ financial skills by providing hands-on experience in managing money, making financial decisions, and understanding economic concepts. They encourage critical thinking, problem-solving, and financial literacy. Through these games, students learn valuable skills such as budgeting, saving, investing, and the importance of making informed financial choices, all in an interactive and engaging manner.

Q5. What is the role of parents in using financial games at home?A5. Parents play a crucial role in using financial games at home. They can support their children by facilitating gameplay, discussing financial concepts, and reinforcing lessons learned. Parents can also help children set savings goals, manage allowances, and apply what they’ve learned in real-life situations. Financial games can spark important family conversations about money and financial responsibility.