A 2019 study determined that the average American has over $90,000 in debt .

The debt landscape is so bad right now that some can’t afford our medical bills. According to TransUnion almost half of all patients don’t pay off hospital bills of $500 or less. Worse, the same source points out that 99% of healthcare invoices aren’t paid off if they’re over $3,000.

Those statistics are the result of a grim reality we face with debt, regardless of which side of the coin you’re on.

If you’re an organization, it’s not going to be easy to collect what’s owed.

If you’re the person who bought the item or service only to find out that you owe a ton of money afterward that you can’t afford to pay, should you even go in the first place?

From this perspective, and to tie in the reference to healthcare from earlier, it’s no wonder so many people try to self-diagnose themselves.

But there’s simply no way for organizations to not charge for the product or service they provide. They still need to pay their employees and keep their lights on.

Of course, there’s a lot that goes into determining pricing. It’s one of the P’s in Neil Borden’s Marketing Mix that’s still taught in universities to this day.

Believe it or not, another hard step during billing is sending the invoice. There are thousands of problems that could arise during this process. Maybe your client moved and their address is incorrect. Or, there’s an error in the services listed within the invoice.

Let’s say you’re the owner of a business and you don’t experience the issues I just mentioned very often. You have a great print and mail services provider that makes these steps easier than ever. As a result, you’re on top of the statement/invoicing process.

Awesome.

But even conquering all of those preliminary steps doesn’t guarantee payment.

So, you send a bill and the patient received it. Problem solved, right? Not exactly. They still have to take the time to resolve it. Maybe your statement’s design isn’t great and they can’t figure out how to pay it off. Or, maybe they just forgot about it.

Whatever the reason for not receiving payment, you’re still expecting it and including it within your accounts receivable calculation already. But let’s say a month goes by and you haven’t received anything.

At this point, the statement is overdue. As a result, you resend it to the patient and include a past due letter within the envelope. This letter acts as a more formal request for payment and a common effort in collections.

Collections? That’s a scary word.

Yes, people tend to cringe when they hear that word. But it’s an integral part of every healthcare organization.

Sending a past due letter is one thing, but they’ll only work effectively if they’re designed well enough to catch the recipients attention. Here are some effective examples and techniques.

The due date for most invoices is between 30 and 90 days days depending on what industry your organization serves.

In other words, you’re giving your clients plenty of time to pay you what they owe. But you’re still going to run into some clients who take their time. Maybe they’re trying to settle other debts before yours? Or, they simply forgot about their balance with you (more on that later)?

Either way, it behooves you to stay in contact with your clients who still owe you money throughout their debt’s entire lifecycle. That means that you need to create an entire campaign of past due letters tied to balance age.

So, when are the best times to send past due letters?

Other than the initial sending of your invoice to your client, it’s a best practice to not reach out to them again until a week before its due date. In theory, that gives them enough time to figure out the logistics of paying you.

If they haven’t satisfied their debt with you and their invoice’s due date is only 7 days away, you should send them a reminder letter out of courtesy.

Capital Resources Inc.

1731 Elliot Avenue

I hope you’re doing well. I’m reaching out to you to remind you that your invoice (#4456) with us is due next week. According to our records, you should’ve received the invoice I’m referring to in the mail on July 5, 2022.

This is a courtesy reminder and we understand that you’re busy. We’d appreciate it if you could take the time this week and go through the invoice when possible.

If you have any questions or doubts as to the invoice, we would be happy to assist you. You can give us a call at (123) 456-7891.

Thank you for taking the time to resolve this matter.

Chief Operating Officer

Stay polite throughout what you send here, their debt with you still isn’t due yet.

Include specific account information such as the client’s invoice number and when they should’ve received it.

Also, include your contact information. It’s possible that this client hasn’t satisfied their debt with you yet because they have a question about it.

If you still haven’t heard anything after sending your first reminder a week before its due date, the next appropriate time to send another letter is on the actual due date itself.

This is the most important past due letter to send. Period.

Yes, the debt still isn’t technically past due yet. But its motive is to catch your clients with outstanding balances at the right time and instill a sense of urgency. There isn’t a more opportune time to accomplish both of those objectives than with this letter.

Cooperative Marketing LLC.

2922 Delaware Avenue

San Francisco, California

You’re receiving this letter in regards to invoice (#78698). It is due today, August 19, 2022. If you remember, we discussed your outstanding invoice a few days ago over the phone. As promised, I’ve sent you this letter as a reminder. You can satisfy your balance with us by paying online or by giving me a call directly at (568) 864-1283.

We also accept checks if you prefer. Address your check to…

Starfleet Group of Companies

Savannah, GA 31420

If you have any questions don't hesitate to reach out.

Thank you for your continued business.

Chief Financial Officer

This letter contains the same data points as the one you sent to your client a week before. What’s different, though, is that it alludes to a phone call campaign during the same week. This is another great tactic to employ.

If you haven’t received payment from your client after sending two courtesy reminders the week of the due date, it’s time to send them your first past due letter.

At this point, you’ve already reached out to the client politely in multiple different ways to include speaking with them. If you’ve gotten this far and they still owe you money…you have no choice but to use a firm approach.

After the due date passes, you have to include the following information in the letters and reminders that you send…

Fresh Fish Distributors

1161 Bell Street

New York, New York

Global Fishery Inc.

4150 Atha Drive

This is a letter notifying you that your balance with us regarding invoice (#94845) is now 7 days overdue. Our records indicate that the due date for your invoice was September 17, 2022.

Tracking information associated with your account indicates that you received this invoice on August 9, 2022. If you never received, we’ve attached the original invoice.

The outstanding balance on this overdue invoice is $68,720. As per our customer agreement, there is now a late fee of 12% tied to this invoice.

You can satisfy this outstanding balance with us through our website, over the phone, or by check.

Let us know the status of your invoice by giving us a call at your earliest convenience. You may reach out to us at (685) 123-1234.

Thank you for your cooperation in this matter.

Chief Financial Officer

If your delinquent client satisfied their balance with you after your first overdue letter you sent then, congratulations.

If they ignored it, you’ll need to send a second one. This one comes 30 days after the last one you sent…and it needs to use even firmer language.

It’s going to contain the same data as before, but you might want to consider offering a payment plan as an option. The reality is that if this client hasn’t paid their balance at this point, you’re going to have to come up with cooperative ways to assist them.

Steel Mill Makers Co.

4719 Columbia Road

ATTN: Valentijin Kok,

You invoice (#3412) is now 48 days overdue. We require your urgent attention to resolve this matter.

We’ve sent multiple correspondence to you regarding this outstanding balance but haven’t heard anything from you. If you can’t satisfy this balance today, we’re willing to arrange a payment plan that works for you.

We sent numerous copies of your invoice to you. If you didn’t receive it, please find the details below…

We accept every major credit and debit card carrier. You may select a payment option that works best from you online at our website or call me directly at (456) 712-1232.

If you’ve had to scroll down this far, I know how frustrated you’re feeling.

By the time you get to this example, your client’s outstanding balance is 90 or more days past due. Not good.

Although I don’t blame you for feeling so frustrated, you need to stay professional throughout your final past due letter.

At this point, though, the letter itself needs to let this client know that you’re transferring their account to a bad debt agency. Trust me, you don’t want to take on the responsibility of writing a debt collection letter .

If the amount due is a large sum and a collection agency isn’t an option, this is an appropriate time to allude to involving a lawyer.

Mill Walkie Brewing

3330 Walkers Ridge Way

Dear Emma Muller,

Your account with us is 111 days past due. This is an urgent matter.

Over the last several months we’ve sent you multiple reminders regarding your outstanding balance. All of our previous attempts haven’t received a reply.

You will find your invoice details below…

We’ve attached the overdue invoice to this letter. Please remit the payment within 2 business days.

If we don’t receive payment for this invoice, we will take legal action.

Just because the industry term is “past due letter” doesn’t mean that it has to be a formal, written document that’s sent through the mail.

The reality is that the patient landscape is changing. They care more about their experience than they ever have before. This means that you should adjust your processes to their preferences.

To give you an example, one of the desires of patients is to make healthcare more accessible. Proof of that comes from the spiking telehealth trends.

Do you think that trend in the healthcare world carries over to the business world? Yes. Your clients want paying you to be easy.

How do you make paying you easy?

Utilize mobile phones.

Specifically, use them as a way to communicate with your clients.

After just 3 minutes of sending a text message, there’s a 90% chance that the person who received it, reads it. That’s the highest open rate of any other form of communication discussed throughout this blog post.

So why not send your past due letter in the form of a text message? That statistic essentially guarantees that your client will read it.

The image above is an example of a past due letter turned into an effective text message.

The first thing you’ll notice is that the “message” is more than one. There’s a reason for this and it also relates to why I broke up this blog post into small paragraphs throughout.

People don’t read and thoroughly as they used to. In fact, almost 80% of web users scan content rather than read it. Thus, I formatted this blog post into small chunks of information so that people (like yourself) who are reading it can quickly extract the main concepts.

OK, but text messages aren’t technically “the internet”.

That’s true, but also keep in mind that 49% of all internet traffic is from mobile phone users.

In other words, many people associate their phone with using the web.

Thus, if you break up your past due letter into skimmable messages your recipients are more likely to understand what you're asking from them. Just be careful not to make the messages too wordy, you don’t want to spam your clients.

Beyond formatting, you’ll notice the “txt STOP to cancel” phrase at the end.

You’re required to include this phrase by law in accordance with the CAN-SPAM act. It allows your recipient to unsubscribe from receiving automated text messages from you.

If they do reply “STOP”, you can’t send them past due letters via text anymore, but at least it means they read it.

There are character limits associated with text messages. In other words, you need to make sure that you keep what you send brief.

With that being said, you can still include important account information in what you send.

Richard, this is Charles from Buy Low, Sell High Financial, your invoice #6873 is due in 7 days. You can pay directly by clicking this link - www.buylowsellhigh.com

Txt STOP to cancel

It shouldn’t be a surprise that the second effective past due letter example I’ve listed in this blog post is the classic physical paper option.

Sending financial and sensitive information via the mail is still the standard operating procedure for many organizations.

It’s even recommended in industry laws like healthcare’s HIPAA Conduit Rule .

It may seem outdated to send something through the mail by younger generations, but it’s still effective.

77% of people still sort through their mail as soon as they grab it out of their mailbox.

Like text messages, that’s an incredibly high open rate that you can’t ignore when trying to collect on your outstanding balances.

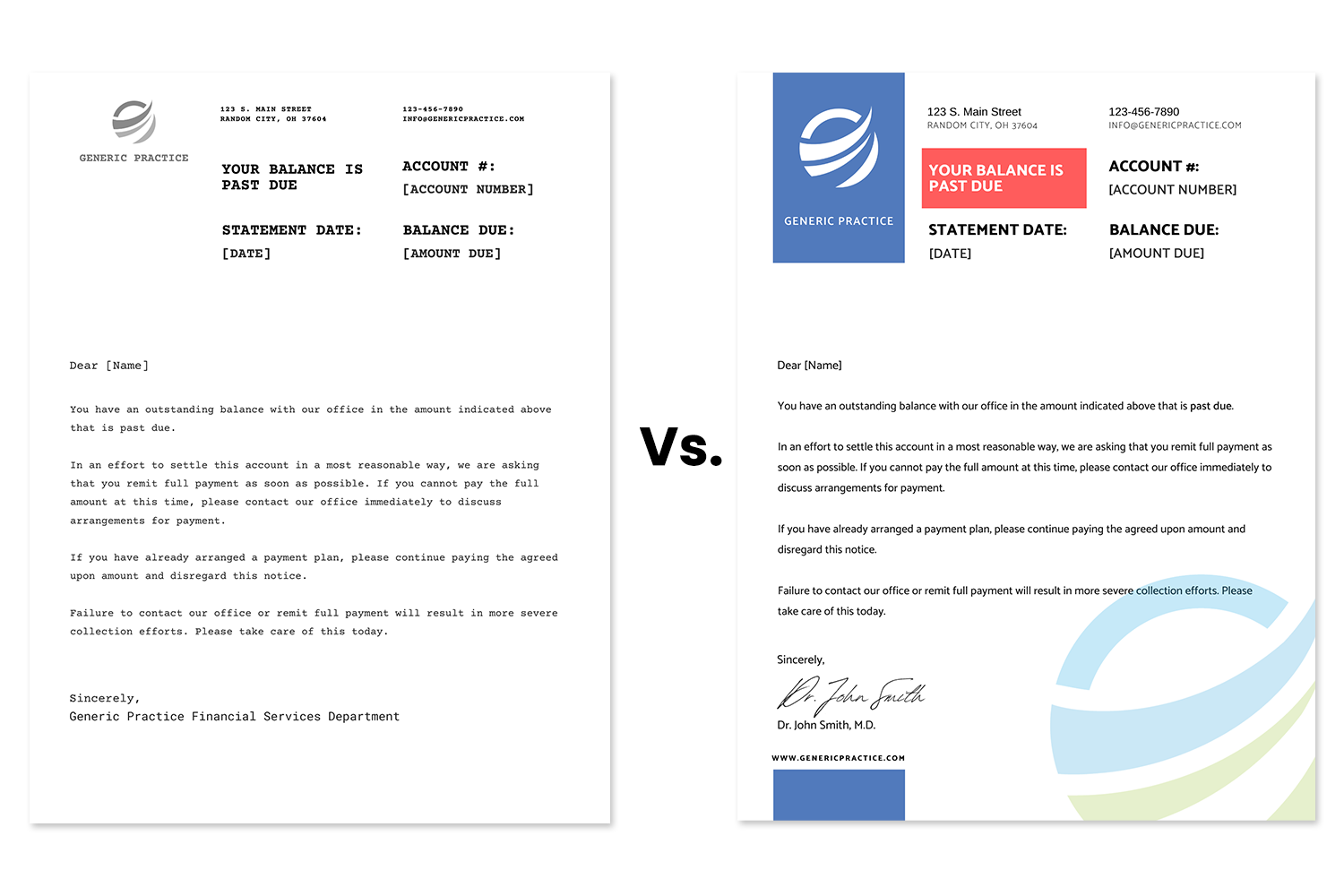

The image above shows two different formats for the same past due letter. At first glance, which one stands out to you the most?

The obvious answer to that question is the one on the right. Its use of color, branding and boldness help tell the reader exactly what to expect without having to read the text within the body.

Out of everything in the right-handed example, the most important part of it is the red, bold box that states very clearly what the letter is. It’s positioned in such a way that that box fits within the window of the envelope the letter gets sent in. A subtle detail that makes it stand out in a massive pile of mail.

The letter on the left is a great example if I had written this blog post in the early 90s. It uses grayscale colors from the font that came from typewriters. Both of which are very much outdated.

Content-wise the letters are the same. Their professional tone isn’t intimidating, which is something you’ll want to stay away from. After all, you don’t want your clients thinking you’re a loan shark. That could lead to legal trouble down the line.

Instead, both of these examples encourage communication with the doctor’s office so that they can help each other resolve the outstanding account. Further, the letters make it very clear that the organization accepts payment plans. Thus, making it easier for recipients to pay what’s owed in a budget-conscious way.

Before I conclude this section, I also want to point out the signature at the bottom of the example on the right. It could either be a photocopied image of a signature or a font. Either way, it adds a nice touch of personalization.

You probably knew that I was going to mention sending your past due letter in the form of an email at some point, right?

Well, that’s because it’s another effective way to let your clients know that they have an outstanding balance.

That’s not that surprising of a statistic if you consider this form of communication is still widely accepted by workforces. Further, it’s only become more accessible with smartphones being able to connect to it.

But, sending a past due letter notification via email is a little bit trickier than something like an appointment reminder.

In either case, the patient you want to send the electronic correspondence to has to opt-in and want to receive them.

Further, you also have to include a way for them to opt-out if they no longer want to receive financial notifications from you this way. That’s similar to the text method I discussed in an earlier section.

What’s most important about using email for your past due letters is the language that you use. Sure, you should maintain a professional tone throughout but that’s not what I’m talking about.

Emailing has that dreaded section that no organization wants to land in, spam.

If your past-due notice lands in the spam folder of the recipient, you might as well chalk it up as wasted effort. Not paying attention to your wording is the fast track to landing in a spam folder.

Unfortunately, emails related to financial matters also happen to be the third-largest category for spam. In other words, it’s really hard to avoid this folder for the emails you send.

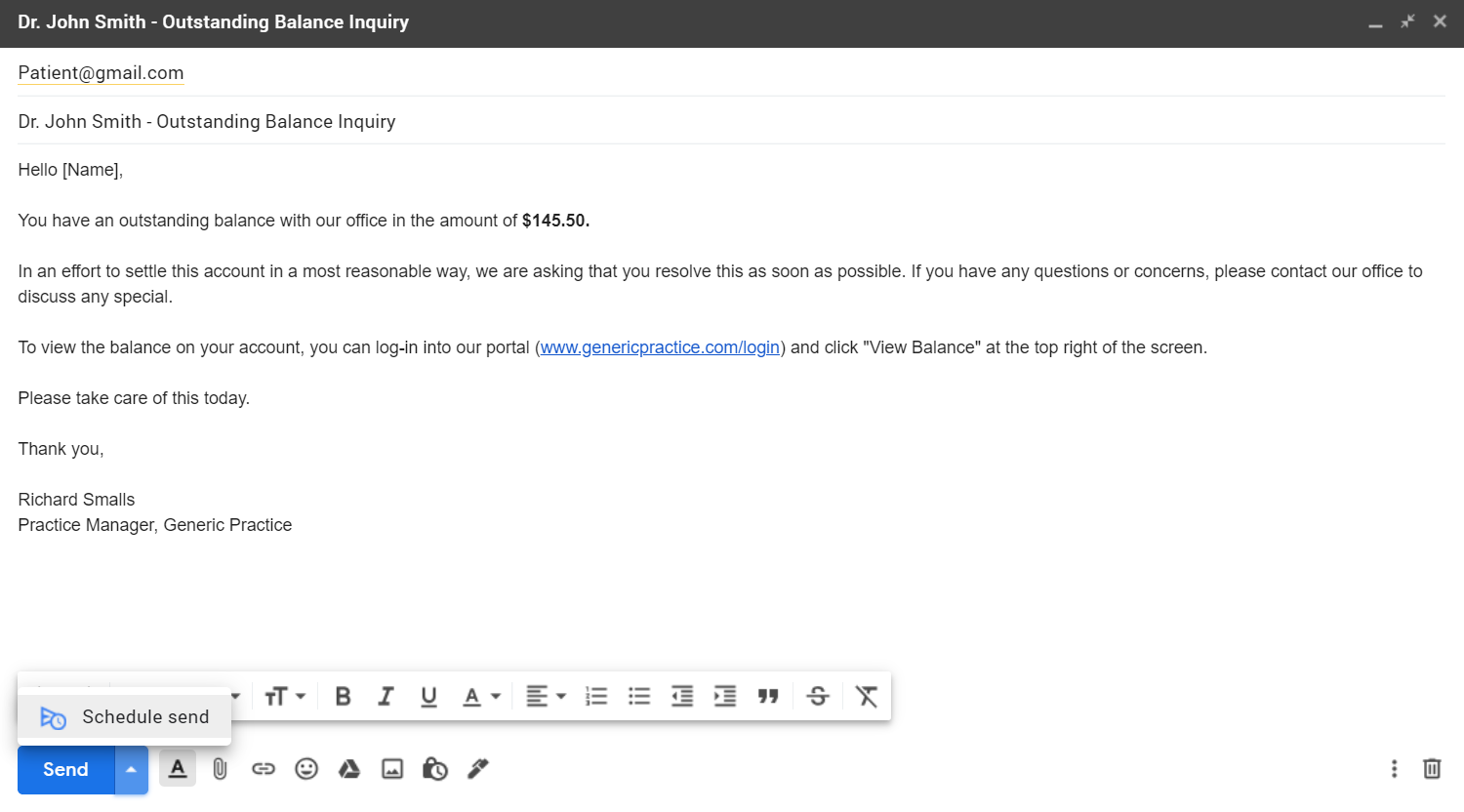

The image above is an example of a past due letter email that would likely land in the recipient’s inbox. There are a few key things to notice.

First, nowhere within it does it say the word payment, yet it’s obvious to the recipient that that’s what the sender is asking for.

Second, sometimes emailers fall into the trap where they mask their website behind the words “click here”. That’s a common trap that malicious hackers use in phishing attacks. This email example lists the entire URL of the website, making it more trustworthy.

One of the best parts about sending your overdue notices via email is its scheduling capabilities.

If you haven’t received any form of contact from multiple clients that you’re trying to receive payment from, take an afternoon to write all of their emails. Adjust the information within each according to who you’re sending it to and then schedule them to go out throughout the upcoming week.

If you’re on Gmail, click on the downward-pointing arrow next to the “Send” button after you’ve finished writing your message

Once clicked, a pop-up window will appear allowing you to choose any date and time in the future that you’d like to schedule your email for sending.

It’s a simple functionality that has a lot of practical use, especially for tackling those balances that are overdue.

You have an outstanding balance with our office for the amount of $165.87.

We're asking that you resolve this balance as soon as possible. If you have any questions or concerns, please contact our office to discuss.

To satisfy your account’s balance, you may log in to our payment portal (www.hometowndrugs.com/payment) and click on “View Balance” at the top right-hand corner of your screen.

Please address this at your earliest convenience.

Dr. Joshua Daniels

Have you ever been in a situation where you meet someone, have a conversation with them and then immediately after they walk away you can’t remember their name? If you’re anything like me, this scenario happens daily.

Am I about to give you a statistic about this phenomenon? Absolutely.

According to Grand Master of Memory, Ed Cooke, you have to actively repeat someone's name at least 30 times before you remember it.

What’s my point after all of this?

The clients that you have to send your past due letters to might have a similar memory problem. Not with names per se but with paying you.

That means you need to let them know multiple times that their balance with you is overdue. As a result, make sure that you place a reminder in multiple places.

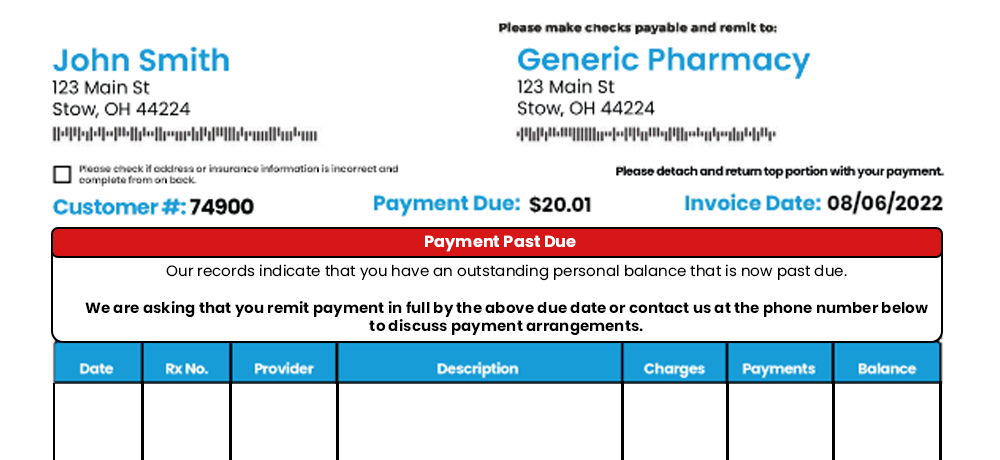

If you’re sending them a physical letter, you’re most likely including another copy of their statement in the same envelope. The statement should have an area devoted to it that reflects the past due status that the letter refers to.

Where should you include this verbiage? In the dunning message area.

If designed correctly, the past due notification will stand out like a sore thumb on the statement. As a result, the recipient will keep their account status in their top frame of mind.

It also serves as a fail-safe in case the recipient skips the frontpage letter altogether.

A dunning message is an add-on that should automatically appear on your invoices based on the status of your client’s accounts.

Although that’s the case, the verbiage you request from your print and mail vendor is important.

Our records indicate that the balance on this account is 34 days overdue. The personal balance on this invoice is your responsibility. Please remit payment in full at your earliest convenience or contact us at the phone number below.

Collecting from clients isn’t a walk in the park. In a perfect world, you provide a product or service and your clients pay you.

However, business veterans know that it won’t ever be that easy. There are way too many steps involved for simplicity's sake.

There’s no one way to avoid outstanding balances. They’re going to happen one way or another.

Implementing an effective past due letter now will make it easier to collect on these future overdue accounts.

Don’t write off accounts that are a couple of months past their original due date as a loss, try one or multiple of the strategies I went over in this blog post and watch your debt collection efforts finally pay off.